Turn your scattered finances into opportunities.

Truthifi is AI financial intelligence.

Unlock one secure platform that monitors, analyzes, and simplifies the full picture of your complex portfolio.

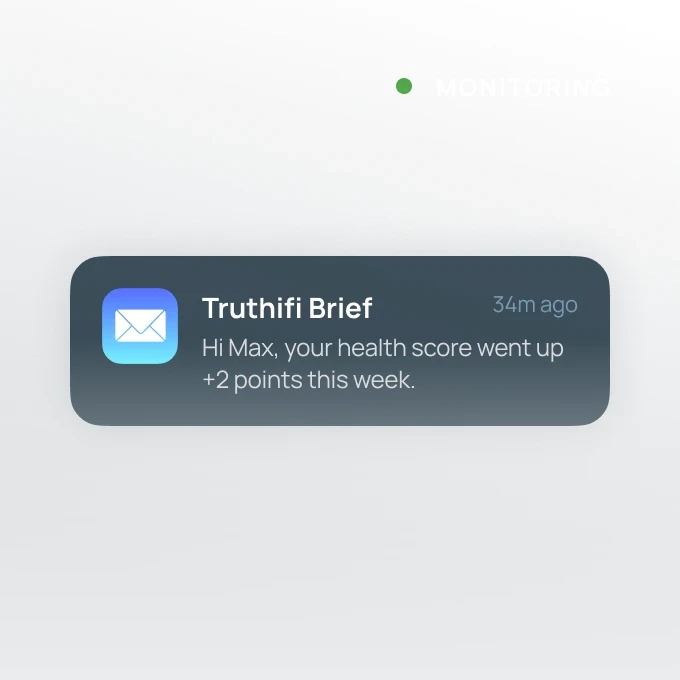

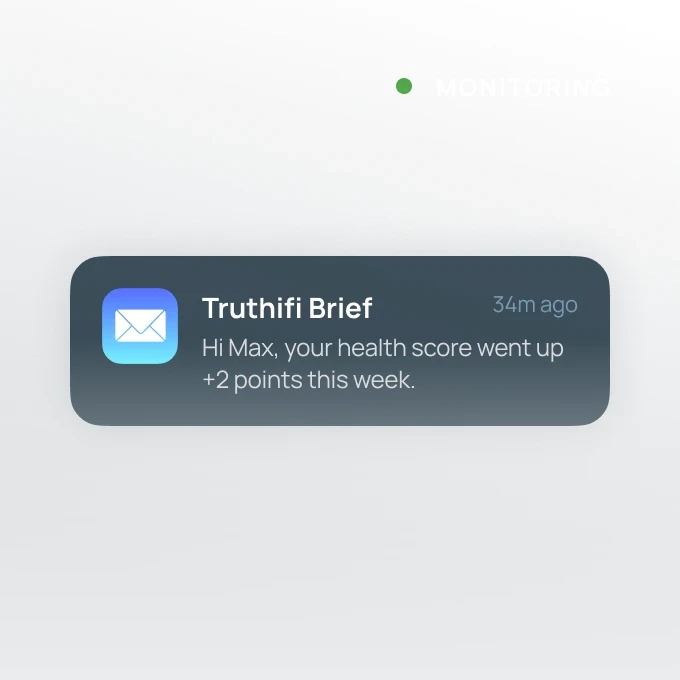

Monitored

$800m+

institutions

18k+

Accuracy

99.7%

Turn your scattered finances into opportunities.

Truthifi is AI financial intelligence.

Unlock one secure platform that monitors, analyzes, and simplifies the full picture of your complex portfolio.

Monitored

$800m+

institutions

18k+

Turn your scattered finances into opportunities.

Truthifi is AI financial intelligence.

Unlock one secure platform that monitors, analyzes, and simplifies the full picture of your complex portfolio.

Monitored

$800m+

institutions

18k+

Accuracy

99.7%

Simple, secure, powerful.

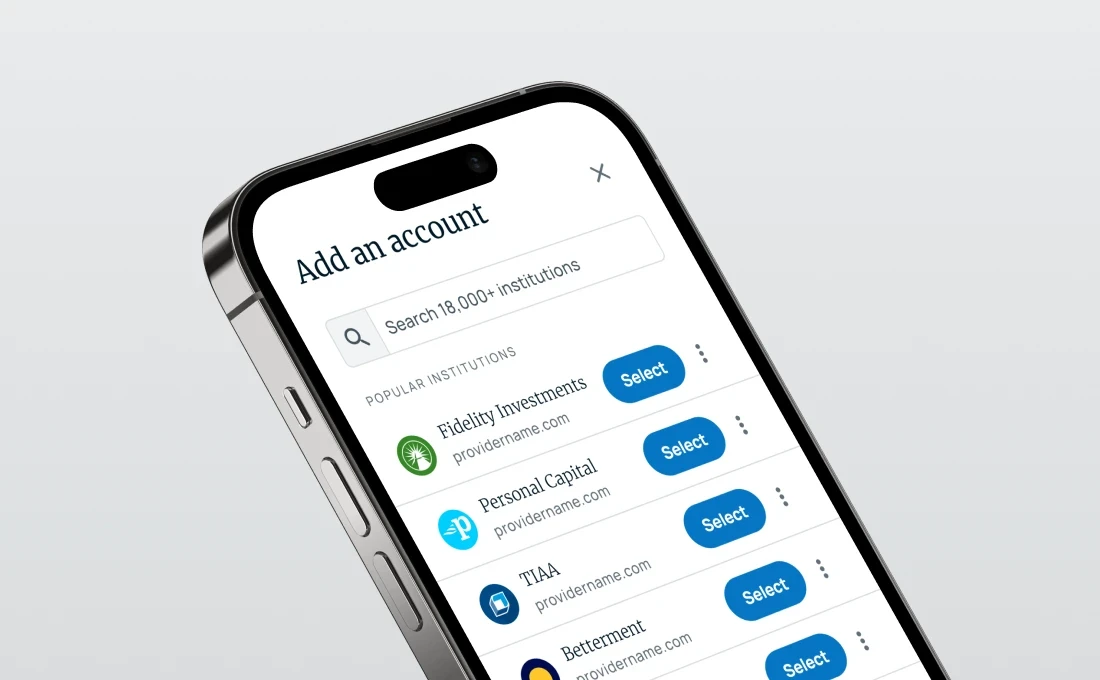

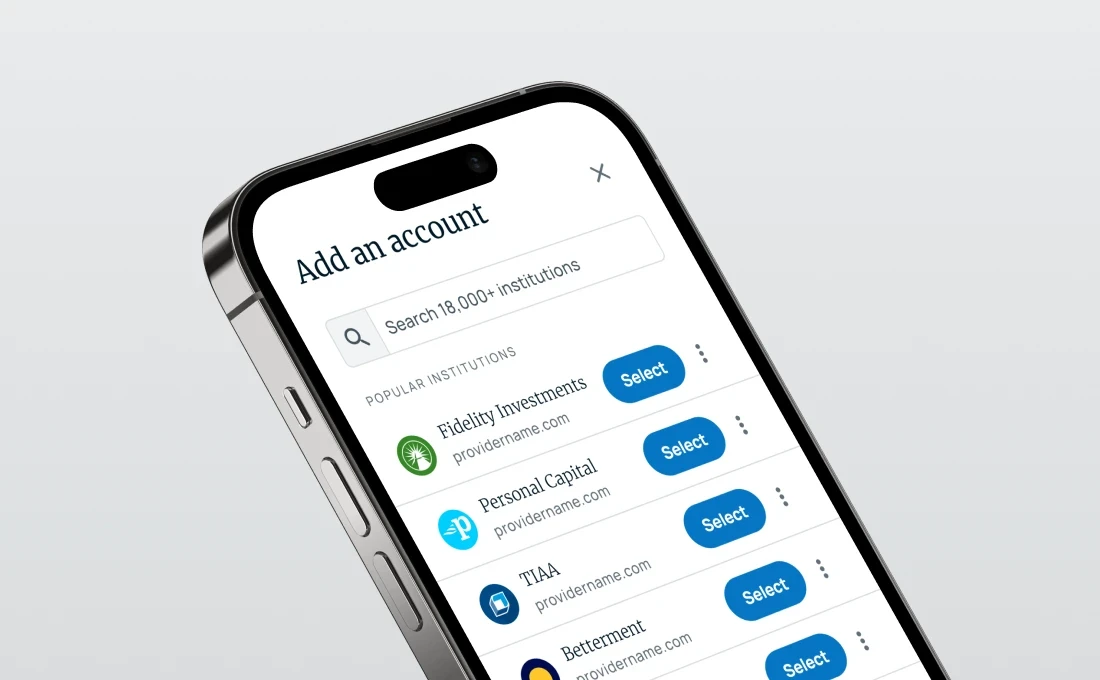

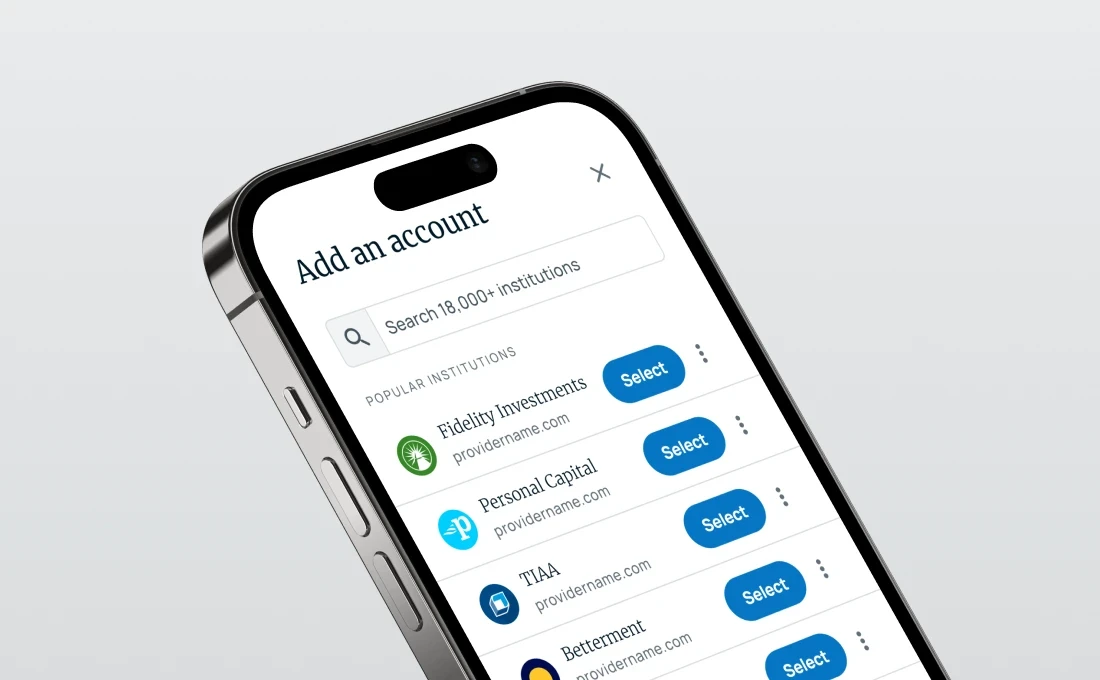

Step 1

Add your accounts.

We use bank-grade encrypted aggregation, read-only access, and work with 18,000+ institutions.

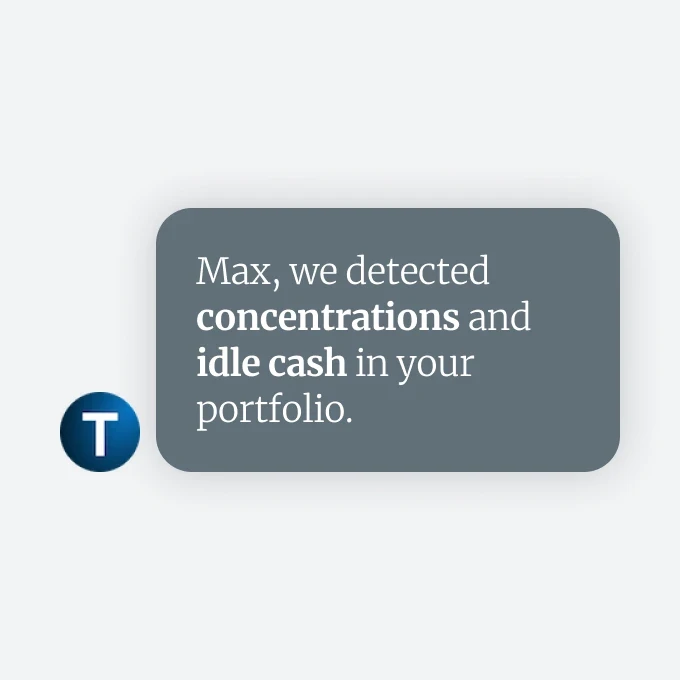

Step 2

We monitor them.

Step 3

Get answers, 24/7.

Simple, secure, powerful.

Step 1

Add your accounts.

We use bank-grade encrypted aggregation, read-only access, and work with 18,000+ institutions.

Step 2

We monitor them.

Step 3

Get answers, 24/7.

Simple, secure, powerful.

Step 1

Add your accounts.

We use bank-grade encrypted aggregation, read-only access, and work with 18,000+ institutions.

Step 2

We monitor them.

Step 3

Get answers, 24/7.

Designed by industry veterans from TIAA, Merrill, Fidelity & more.

Designed by industry veterans from TIAA, Merrill, Fidelity & more.

Designed by industry veterans from TIAA, Merrill, Fidelity & more.

Every investor deserves a second set of eyes.

Retirement-focused

You've spent decades building toward retirement. Make sure it'll hold.

Retirement

Dividends

Equity exposure

Withdrawals

Do-it-yourself

You're hands-on. Get an independent read without an agenda.

Benchmarking

Expense ratios

Net returns

Low-rank funds

Strategically complex

Complexity compounds at this level. Watch the details that matter.

All assets

Tax impact

Fees

Concentrations

Value & ESG-driven

Your investments should reflect what you care about. Verify that they do.

ESG score

Bank rating

Sectors

Industries

Focused on saving

You're still building wealth. Catch potentially risky habits early.

Spending

Debt

Goals

Cash sitting idle

Advisors & more

Your clients trust you. Unlock the data that makes that trust bulletproof.

Book health

Client side

Engagement

Held-away

Every investor deserves a second set of eyes.

Retirement-focused

You've spent decades building toward retirement. Make sure it'll hold.

Retirement

Dividends

Equity exposure

Withdrawals

Do-it-yourself

You're hands-on. Get an independent read without an agenda.

Benchmarking

Expense ratios

Net returns

Low-rank funds

Strategically complex

Complexity compounds at this level. Watch the details that matter.

All assets

Tax impact

Fees

Concentrations

Value & ESG-driven

Your investments should reflect what you care about. Verify that they do.

ESG score

Bank rating

Sectors

Industries

Focused on saving

You're still building wealth. Catch potentially risky habits early.

Spending

Debt

Goals

Cash sitting idle

Advisors & more

Your clients trust you. Unlock the data that makes that trust bulletproof.

Book health

Client side

Engagement

Held-away

Every investor deserves a second set of eyes.

Retirement-focused

You've spent decades building toward retirement. Make sure it'll hold.

Retirement

Dividends

Equity exposure

Withdrawals

Do-it-yourself

You're hands-on. Get an independent read without an agenda.

Benchmarking

Expense ratios

Net returns

Low-rank funds

Strategically complex

Complexity compounds at this level. Watch the details that matter.

All assets

Tax impact

Fees

Concentrations

Value & ESG-driven

Your investments should reflect what you care about. Verify that they do.

ESG score

Bank rating

Sectors

Industries

Focused on saving

You're still building wealth. Catch potentially risky habits early.

Spending

Debt

Goals

Cash sitting idle

Advisors & more

Your clients trust you. Unlock the data that makes that trust bulletproof.

Book health

Client side

Engagement

Held-away

Built by people who know financial systems.

Truthifi® was built by people who believe financial clarity should actually help people win—not confuse them. With Truthifi®, you’re not just using software; you’re working with a team that’s invested in getting this right.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Built by people who know financial systems.

Truthifi® was built by people who believe financial clarity should actually help people win—not confuse them. With Truthifi®, you’re not just using software; you’re working with a team that’s invested in getting this right.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Built by people who know financial systems.

Truthifi® was built by people who believe financial clarity should actually help people win—not confuse them. With Truthifi®, you’re not just using software; you’re working with a team that’s invested in getting this right.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

What you get

Clear answers

Ask the agent your biggest financial questions—and get clear answers.

Instant clarity

Translate your numbers into wellness insights—right on your dashboard.

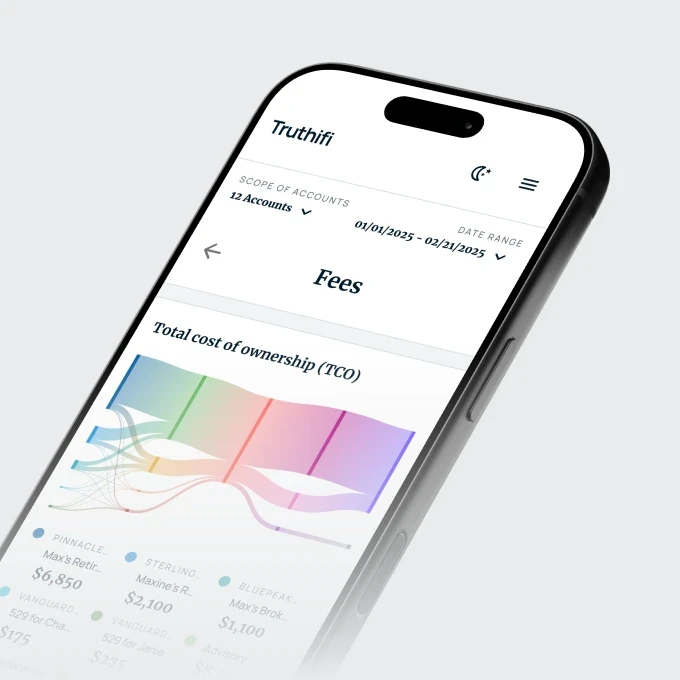

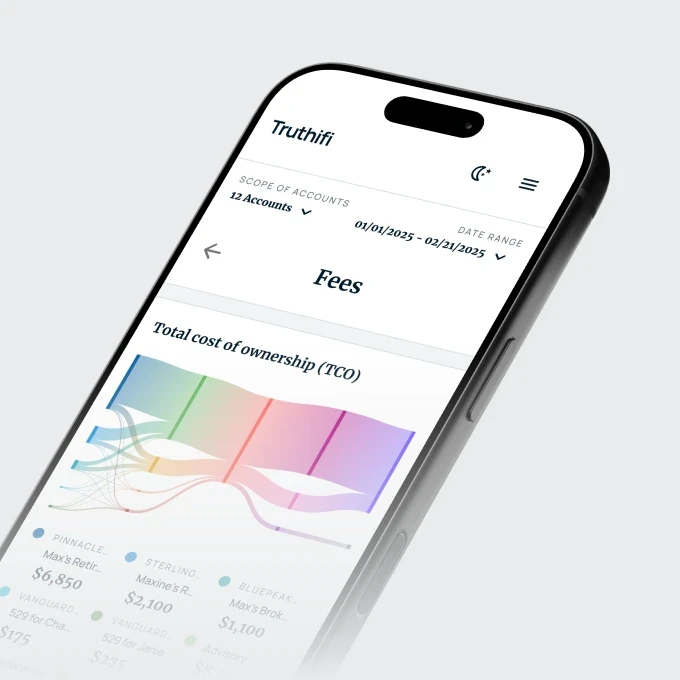

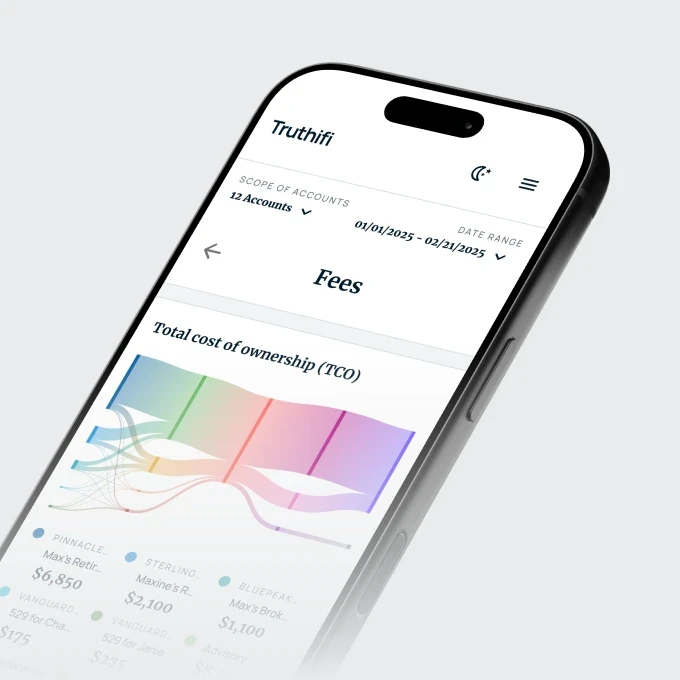

Better deep dives

Explore rich visualizations of performance, fees, allocation, and more.

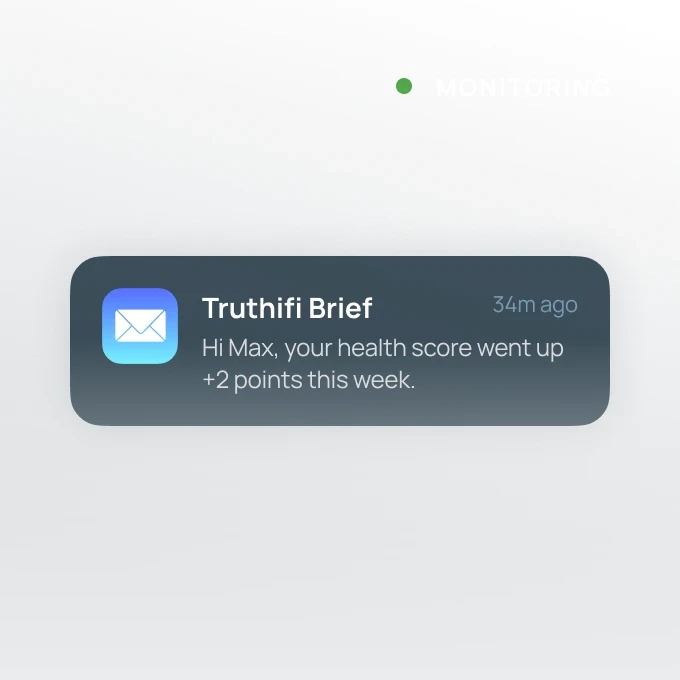

Automatic updates

We continuously run over 100 wellness checks on your wealth in the background.

A simple hub

Get a clear birds-eye view of everything that’s going on across your accounts.

18,000+ institutions

We support secure connections to 18k+ financial providers.

What you get

Clear answers

Ask the agent your biggest financial questions—and get clear answers.

Instant clarity

Translate your numbers into wellness insights—right on your dashboard.

Better deep dives

Explore rich visualizations of performance, fees, allocation, and more.

Automatic updates

We continuously run over 100 wellness checks on your wealth in the background.

A simple hub

Get a clear birds-eye view of everything that’s going on across your accounts.

18,000+ institutions

We support secure connections to 18k+ financial providers.

What you get

Clear answers

Ask the agent your biggest financial questions—and get clear answers.

Instant clarity

Translate your numbers into wellness insights—right on your dashboard.

Better deep dives

Explore rich visualizations of performance, fees, allocation, and more.

Automatic updates

We continuously run over 100 wellness checks on your wealth in the background.

A simple hub

Get a clear birds-eye view of everything that’s going on across your accounts.

18,000+ institutions

We support secure connections to 18k+ financial providers.

Start free. Upgrade if it makes sense.

1

Portfolio setup

FREE

Add accounts and financial advisors for free. (It’s easy to remove them if you change your mind.)

2

First checkup

FREE

Unlock financial wellness preview and a baseline picture of where things stand—all for free.

3

Premium insights

PAID

Unlock 24/7 monitoring, AI answers, and the complete suite of 100+ premium wellness diagnostics when you upgrade to Monitoring or Monitoring+.

Truthifi financial wellness membership

$79.99

/ year

That’s less than $7/mo.

Free for the first 30 days.

No credit card required.

Start free. Upgrade if it makes sense.

1

Portfolio setup

FREE

Add accounts and financial advisors for free. (It’s easy to remove them if you change your mind.)

2

First checkup

FREE

Unlock financial wellness preview and a baseline picture of where things stand—all for free.

3

Premium insights

PAID

Unlock 24/7 monitoring, AI answers, and the complete suite of 100+ premium wellness diagnostics when you upgrade to Monitoring or Monitoring+.

Truthifi financial wellness membership

$79.99

/ year

That’s less than $7/mo.

Free for the first 30 days.

No credit card required.

Start free. Upgrade if it makes sense.

1

Portfolio setup

FREE

Add accounts and financial advisors for free. (It’s easy to remove them if you change your mind.)

2

First checkup

FREE

Unlock financial wellness preview and a baseline picture of where things stand—all for free.

3

Premium insights

PAID

Unlock 24/7 monitoring, AI answers, and the complete suite of 100+ premium wellness diagnostics when you upgrade to Monitoring or Monitoring+.

Truthifi financial wellness membership

$79.99

/ year

That’s less than $7/mo.

Free for the first 30 days.

No credit card required.

Find an error, get a free upgrade.

When you sign up, we rebuild your historical data—filling gaps and fixing errors most trackers overlook. If you spot something our data repair engine missed, we'll upgrade your account, on us.

Find an error, get a free upgrade.

When you sign up, we rebuild your historical data—filling gaps and fixing errors most trackers overlook. If you spot something our data repair engine missed, we'll upgrade your account, on us.

Find an error, get a free upgrade.

When you sign up, we rebuild your historical data—filling gaps and fixing errors most trackers overlook. If you spot something our data repair engine missed, we'll upgrade your account, on us.

Trusted by $800m AUM

Here’s what our customers are saying.

“I use Truthifi to see all my investments in one place, compare fees and performance, and sleep better at night knowing the truth about my portfolio.”

Ted S.

User since 2023

“Truthifi has revealed to me substantial stock concentrations in my funds that I was unaware of, thanks to this I made more informed financial decisions, I highly recommend it…”

Marco S.

User since 2022

“Since signing up for Truthifi I have become far more knowledgeable about the allocation of my assets, my investment returns and the costs associated with the management process.”

Craig B.

User since 2021

“So eye opening! These details and the print out option will help me have a more informed discussion with my advisor.”

Kim D.

User since 2023

“I am so happy with my Truthifi account- I can easily see all my money in one place… finally… and I know what’s going on with hidden fees, this is a game changer that we all deserve…”

Regina W.

User since 2024

“Truthifi allows me to cut through the noise, providing a single source of truth for how all my assets and managers are performing. I simply trust Truthifi.”

Mike M.

User since 2024

“I recently had a meeting with my wealth advisor and with the help of Truthifi I was able to have a meaningful conversation with him...”

Kevin M.

User since 2023

Trusted by $800m AUM

Here’s what our customers are saying.

“I use Truthifi to see all my investments in one place, compare fees and performance, and sleep better at night knowing the truth about my portfolio.”

Ted S.

User since 2023

“Truthifi has revealed to me substantial stock concentrations in my funds that I was unaware of, thanks to this I made more informed financial decisions, I highly recommend it…”

Marco S.

User since 2022

“Since signing up for Truthifi I have become far more knowledgeable about the allocation of my assets, my investment returns and the costs associated with the management process.”

Craig B.

User since 2021

“So eye opening! These details and the print out option will help me have a more informed discussion with my advisor.”

Kim D.

User since 2023

“I am so happy with my Truthifi account- I can easily see all my money in one place… finally… and I know what’s going on with hidden fees, this is a game changer that we all deserve…”

Regina W.

User since 2024

“Truthifi allows me to cut through the noise, providing a single source of truth for how all my assets and managers are performing. I simply trust Truthifi.”

Mike M.

User since 2024

“I recently had a meeting with my wealth advisor and with the help of Truthifi I was able to have a meaningful conversation with him...”

Kevin M.

User since 2023

Trusted by $800m AUM

Here’s what our customers are saying.

“I use Truthifi to see all my investments in one place, compare fees and performance, and sleep better at night knowing the truth about my portfolio.”

Ted S.

User since 2023

“Truthifi has revealed to me substantial stock concentrations in my funds that I was unaware of, thanks to this I made more informed financial decisions, I highly recommend it…”

Marco S.

User since 2022

“Since signing up for Truthifi I have become far more knowledgeable about the allocation of my assets, my investment returns and the costs associated with the management process.”

Craig B.

User since 2021

“So eye opening! These details and the print out option will help me have a more informed discussion with my advisor.”

Kim D.

User since 2023

“I am so happy with my Truthifi account- I can easily see all my money in one place… finally… and I know what’s going on with hidden fees, this is a game changer that we all deserve…”

Regina W.

User since 2024

“Truthifi allows me to cut through the noise, providing a single source of truth for how all my assets and managers are performing. I simply trust Truthifi.”

Mike M.

User since 2024

“I recently had a meeting with my wealth advisor and with the help of Truthifi I was able to have a meaningful conversation with him...”

Kevin M.

User since 2023

Real people. Real answers. Happy to help.

Security concerns? Questions about results? Need tech support? Drop us a line anytime. We’re here to help.

Real people. Real answers. Happy to help.

Security concerns? Questions about results? Need tech support? Drop us a line anytime. We’re here to help.

Real people. Real answers. Happy to help.

Security concerns? Questions about results? Need tech support? Drop us a line anytime. We’re here to help.

Common questions about wealth monitoring

What is Truthifi?

Truthifi is a wealth monitoring platform that continuously watches complex portfolios for risk, fees, concentration, and drift.

What is wealth monitoring?

Wealth monitoring is the ongoing process of automatically watching your financial accounts and investments to make sure nothing drifts from your intended strategy. Truthifi continuously monitors portfolios for risk, fees, concentration, and other issues without requiring daily involvement.

How is this different from tracking apps?

Most tracking apps show balances and performance. Truthifi monitors for deeper issues like risk changes, rising fees, concentrations, and strategy misalignment as your financial life evolves.

Do I still need a financial advisor if I use Truthifi?

Truthifi is designed to complement financial advisors, not replace them. Many investors use Truthifi alongside advisors to stay informed between meetings and feel confident that nothing important is being missed.

Who is Truthifi best for?

Truthifi is ideal for investors with multiple accounts, professional advisors, or complex portfolios who want confidence without micromanagement.

Common questions about wealth monitoring

What is Truthifi?

Truthifi is a wealth monitoring platform that continuously watches complex portfolios for risk, fees, concentration, and drift.

What is wealth monitoring?

Wealth monitoring is the ongoing process of automatically watching your financial accounts and investments to make sure nothing drifts from your intended strategy. Truthifi continuously monitors portfolios for risk, fees, concentration, and other issues without requiring daily involvement.

How is this different from tracking apps?

Most tracking apps show balances and performance. Truthifi monitors for deeper issues like risk changes, rising fees, concentrations, and strategy misalignment as your financial life evolves.

Do I still need a financial advisor if I use Truthifi?

Truthifi is designed to complement financial advisors, not replace them. Many investors use Truthifi alongside advisors to stay informed between meetings and feel confident that nothing important is being missed.

Who is Truthifi best for?

Truthifi is ideal for investors with multiple accounts, professional advisors, or complex portfolios who want confidence without micromanagement.

Common questions about wealth monitoring

What is Truthifi?

Truthifi is a wealth monitoring platform that continuously watches complex portfolios for risk, fees, concentration, and drift.

What is wealth monitoring?

Wealth monitoring is the ongoing process of automatically watching your financial accounts and investments to make sure nothing drifts from your intended strategy. Truthifi continuously monitors portfolios for risk, fees, concentration, and other issues without requiring daily involvement.

How is this different from tracking apps?

Most tracking apps show balances and performance. Truthifi monitors for deeper issues like risk changes, rising fees, concentrations, and strategy misalignment as your financial life evolves.

Do I still need a financial advisor if I use Truthifi?

Truthifi is designed to complement financial advisors, not replace them. Many investors use Truthifi alongside advisors to stay informed between meetings and feel confident that nothing important is being missed.

Who is Truthifi best for?

Truthifi is ideal for investors with multiple accounts, professional advisors, or complex portfolios who want confidence without micromanagement.

Upgrade the way you look after your wealth.

$800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

Upgrade the way you look after your wealth.

$800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal